Software to Software Conversion Hub

We migrate your data from any platform to any platform – securely, accurately, and with minimal downtime. From email and collaboration to ERP, CRM, and finance, we orchestrate every step.

Battle-tested playbooks and validated checklists for every workload.

Least-privilege access, encrypted transport, and audit trails for every change.

Validation at every stage with rollback plans and recovery checkpoints.

Solution architects, project managers, and cutover engineers aligned to your team.

Full-suite move with coexistence, calendars, and shared drives.

Exchange, OneDrive, and Teams into Gmail, Drive, and Chat.

Chart of accounts remapping and multi-entity support.

Transaction history, vendors, and customers aligned.

Object mapping with deduplication and lifecycle states.

Custom fields, roles, and automation handover.

Preserve permissions and sharing links with minimal downtime.

Metadata, folders, and external collaborators carried over.

Epics, sprints, and attachments migrated for dev continuity.

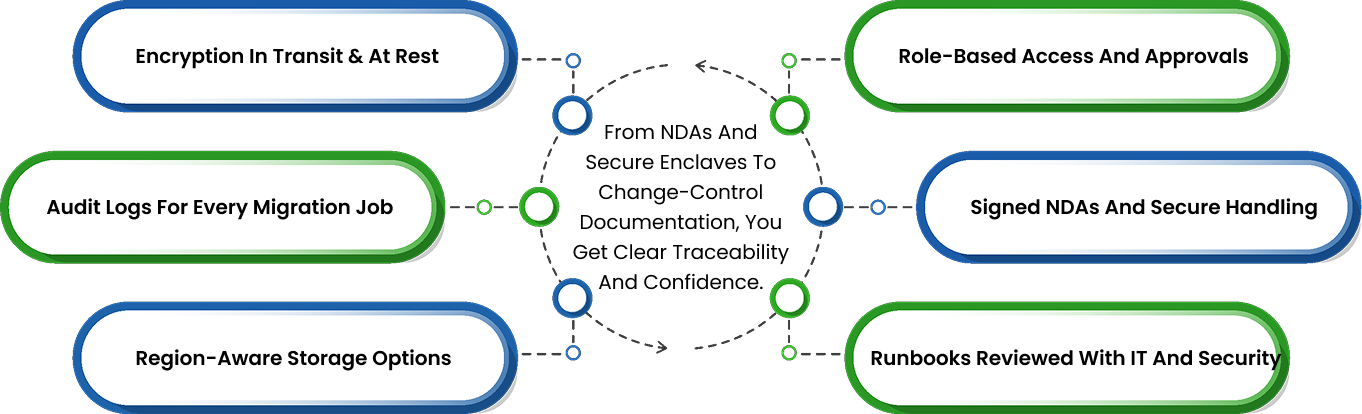

Every engagement is built with controls to satisfy IT, InfoSec, and audit stakeholders. We align to your governance posture without slowing down delivery.

Delivered staged coexistence, identity clean-up, and weekend cutover to keep plants online worldwide.

Rebuilt information architecture, preserved permissions, and validated compliance tagging for auditors.

Rebuilt information architecture, preserved permissions, and validated compliance tagging for auditors.